Clartan SICAV

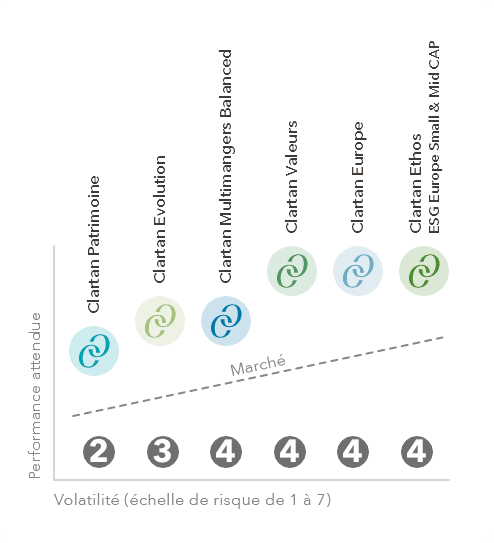

Our expertise, equity management, finds its expression in the six compartments of our Clartan SICAV, which offer a range of performance and volatility profiles.

A European SICAV

Clartan Associés elected to bring together the funds it manages in a Luxembourg-registered SICAV.

Luxembourg is at the heart of the eurozone in the fields of domiciliation and administration of investment funds, thanks to its strong culture of investor protection, backed by political, regulatory and social stability.

Shareholders in the Clartan SICAV therefore benefit from the best international standards in custodian bank activities

Contact the sales team

Find out more about our solutions.

Quality & Value

Capital management is offered through the six compartments of our SICAV.

Clartan Patrimoine

Created in 1991, this predominantly bond-based fund is aimed at investors preferring savings with little exposure to market fluctuations. With an emphasis on capital preservation, it seeks capital growth for investments over a period of more than two years.

Clartan Evolution

Launched in 2012, Clartan Evolution seeks to optimise, over a period of at least five years, the risk-return profile relative to global markets. Between 20% and 70% of assets are invested in shares in listed companies, and the remainder in well-rated bonds.

Clartan Valeurs

Founded in 1991, this fund aims to generate absolute returns over a period of at least five years by capturing the earnings growth of companies and/or the benefits of a market rerating of the shares held.

Clartan Europe (éligible au PEA

Created in 2003, this fund is invested exclusively in European equities and seeks to outperform the yearly average performance of the main European equity indices over the long term.

Clartan Ethos ESG Europe Small & Mid CAP (éligible au PEA)

Created in 2020, this fund is invested exclusively in small and mid-cap European equities and seeks to generate capital growth and to outperform the yearly average performance of its main benchmark equity indices over the long term. It also aims to invest in a responsible and sustainable manner (positive impact).

Clartan Multimangers Balanced

Created in 2016, this fund seeks to generate capital growth over the long term through discretionary asset allocation. Equity exposure can vary between 20% and 70%.

Subscribe to our Monthly report

If you wish to receive our monthly report in your mailbox, please subscribe here.